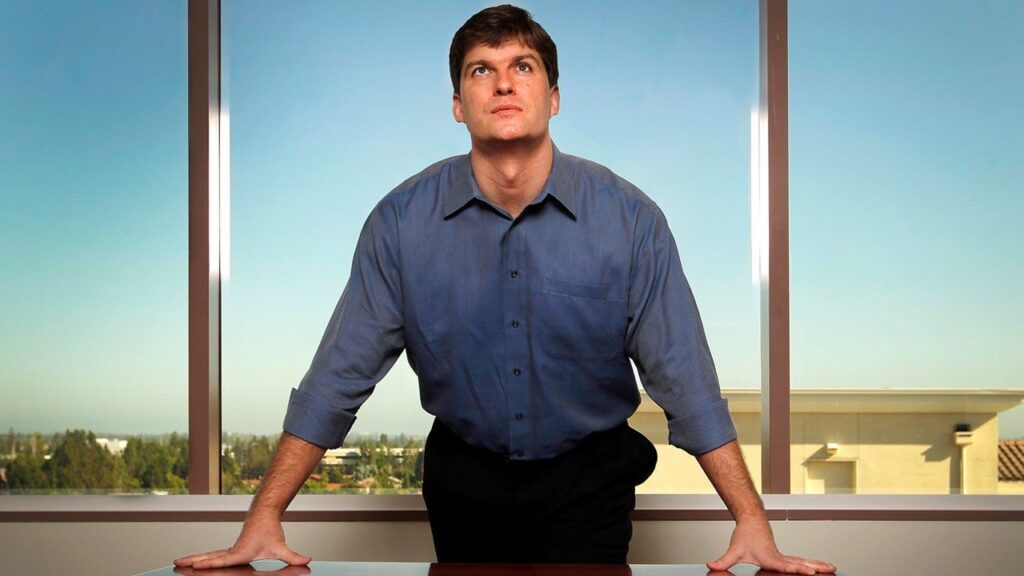

👤 Who Is Michael Burry — and Why His Move Matters

Michael Burry is a legendary investor best known for his role in predicting the 2008 financial crisis, a story famously chronicled in The Big Short. His hedge fund, which rode the housing-market collapse to legendary profits, made him a household name in financial circles. Over the years, Burry has remained an outspoken and contrarian voice — sometimes quietly, sometimes controversially — on big macro trends.

In 2025, he made a striking announcement: he deregistered his hedge fund. This move has sparked major conversations across Wall Street and among individual investors. What does it mean for Burry? What does it mean for the broader market? Let’s dig in.

🧭 Why Michael Burry Deregistered the Fund

Analysts point to several possible reasons for Burry’s decision:

- Lower Operational Burdens: By removing regulatory obligations, Burry frees himself from the compliance and reporting demands that strain smaller funds.

- Changing Strategy: He may be shifting away from a traditional hedge-fund structure toward a more private or personal investment setup — possibly focusing on long-term value plays rather than short-term trading.

- Limited Capacity and Scale: Managing outside capital can be stressful, especially for niche, high-conviction bets. Deregistration could allow him to concentrate on his own capital or a smaller group of trusted backers.

- Disenchantment with Public Markets: In recent years, Burry has expressed skepticism about macro bubbles, inflation, and monetary policy. This step might reflect a desire to sit out of some market dynamics or reallocate his money entirely.

🌐 Market Implications and Reactions

Burry’s move didn’t go unnoticed — investors and market watchers are interpreting it in multiple ways:

- Contrarian Signal: For many long-time followers, Burry’s exit from the hedge fund game signals a warning about current risk levels. If he’s stepping aside, some think he sees major headwinds ahead.

- Resetting Priorities: It could mean that Burry is no longer prioritizing growth for others, but rather preserving and growing his own wealth in a more controlled way.

- Influence Still Intact: Even without a registered fund, his views could carry more weight. He may continue to trade big, influential positions or publish research — and markets may still react to his idea flow.

- Potential Comeback Setup: This could be a strategic pause. By deregistering now, he retains flexibility to launch a new vehicle in the future under more favorable conditions.

🔭 What Michael Burry Might Do Next

While he hasn’t publicly revealed his entire game plan, several plausible paths lie ahead:

- Private Investment Vehicle: Burry could run a private fund, investing only his own or a small circle’s capital.

- Concentrated Portfolio: He may focus on a small number of high-conviction bets — possibly in undervalued sectors or long-term structural trends.

- Research & Commentary: Known for his detailed thesis-driven analysis, Burry might increase his publishing of market insights or macro calls.

- Philanthropy or New Ventures: With fewer regulatory encumbrances, he could explore social impact investing or new business initiatives outside traditional fund management.

❓ Frequently Asked Questions (FAQ)

Q1. What exactly does “deregistering a hedge fund” mean?

It means closing or suspending its formal registration with regulatory bodies, reducing regulatory burdens and usually limiting external capital.

Q2. Does this mean Michael Burry is retiring?

Not necessarily. Deregistration doesn’t equal retirement — he could continue investing personally or through another structure.

Q3. Will market players take his move as a warning sign?

Many may interpret it that way, given his history of contrarian macro calls. But some see it as a personal restructuring rather than a market prediction.

Q4. Can Burry still make big trades after deregistering?

Yes. He can trade his own capital. His trading could remain highly influential, even without outside investors.

Q5. Is this move common for hedge fund managers?

Occasionally. Some managers deregister when they want more flexibility, fewer regulatory costs, or to scale down.

Ford CEO Speaks Out on Tesla and Chinese EVs: “The Real Competition Is Just Beginning”

🔮 Final Thoughts

Michael Burry’s decision to deregister his hedge fund is a bold move that underscores his unique approach to investing. He’s not just stepping back — he’s potentially repositioning himself for what comes next.

With a legacy built on contrarian success, Burry’s next chapter could be even more intriguing than his last. Whether he plays it safe or swings for a new kind of moonshot, the investment world will be watching.