Electoral Bonds Revelation: SBI’s Compliance and the Unveiling of Crucial Data

In a significant development related to the controversial electoral bonds, the State Bank of India (SBI) has recently submitted a comprehensive compliance affidavit to the Supreme Court. This affidavit sheds light on a multitude of details surrounding the electoral bonds, emphasizing transparency and adherence to the court’s directives.

The Affidavit Unveiled: A Glimpse into Electoral Bond Transactions

The Chief Managing Director of SBI, Dinesh Khara, filed the affidavit with the Supreme Court, divulging crucial information related to the purchase and redemption of electoral bonds. The data spans from April 1, 2019, to February 15, 2024, during which a staggering 22,217 bonds were purchased. Out of this considerable number, 22,030 electoral bonds found redemption.

A noteworthy aspect highlighted in the affidavit is the fate of electoral bonds that remained unencashed within the stipulated 15-day validity period. Instead of going unused, these bonds were redirected to the Prime Minister’s relief funds, as clarified by the SBI.

Detailed Records: A Testament to Transparency

The compliance affidavit affirms the meticulous record-keeping maintained by the State Bank of India. It asserts, “ready records in which the date of purchase, denomination, and name of the buyer were recorded, and [in relation to the political parties] the date of encashment and the denominations of the bonds encashed were recorded.”

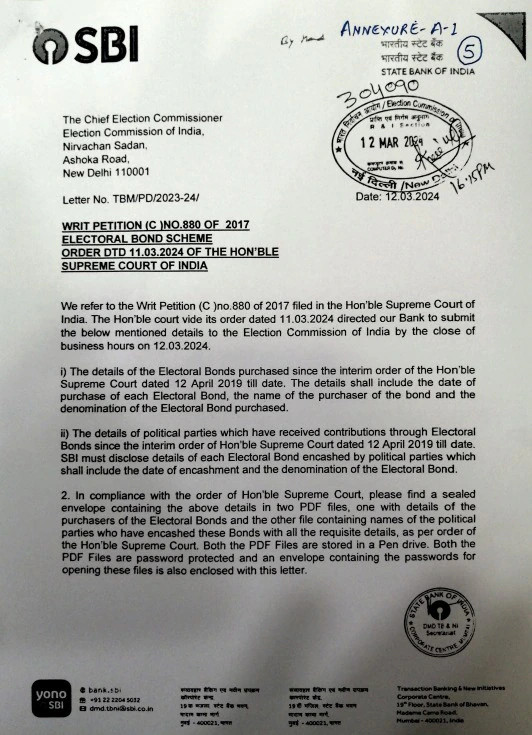

In alignment with the court’s directives, the SBI took swift action to provide the Election Commission of India (ECI) with the required information. The bank, before the end of business hours on March 12, 2024, delivered a digital record, safeguarded by a password, to the ECI.

“The date of purchase of each Electoral Bond, the name of the purchaser, and the denomination of the Electoral Bond purchased has been furnished. The date of encashment of the Electoral Bonds, the name of political parties who have received the contributions, and the denomination of the said bonds has also been furnished,” stated the SBI in the affidavit.

Timely Compliance: SBI’s Commitment to Judicial Orders

Sources reveal that the State Bank of India has diligently complied with the court’s orders, submitting the comprehensive details of electoral bonds to the Election Commission. Notably, the SBI has issued electoral bonds amounting to a substantial Rs 16,518 crore in 30 tranches since the inception of the scheme in 2018.

However, the Supreme Court, in a landmark decision on February 15, dealt a blow to the electoral bonds scheme. The court declared the scheme, allowing anonymous political funding, as “unconstitutional” and mandated disclosure by the Election Commission of donors, donated amounts, and recipients.

The Road Ahead: Scrutiny and Public Disclosure

Despite SBI’s initial plea for time until June 30 to disclose the details, the court rejected the extension and urged the bank to submit all pertinent information to the Election Commission by the close of working hours on Tuesday. This development marks a pivotal moment in the push for transparency in political funding, emphasizing the significance of public awareness and scrutiny in electoral processes.

In conclusion

The compliance affidavit submitted by the State Bank of India not only signifies adherence to judicial directives but also underscores the importance of transparency in electoral processes. As the electoral bonds saga unfolds, it prompts a reevaluation of political funding mechanisms, pushing for a more open and accountable democratic system.