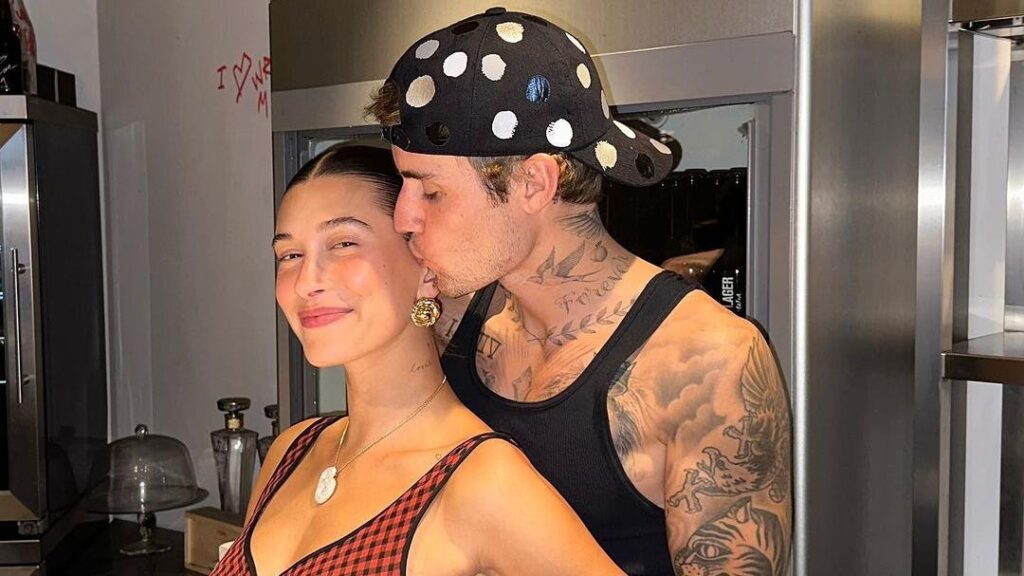

Justin Bieber and Hailey Bieber recently celebrated their 7th wedding anniversary, taking to social media to reflect on their relationship and family values. The pop star shared candid insights into the couple’s approach to marriage, highlighting the rules that help them stay connected and maintain a healthy partnership.

Celebrating 7 Years Together

On Instagram, Justin Bieber posted a heartfelt message about his life with Hailey, noting how their marriage has grown stronger over the years. The couple, married in 2018, has been open about the importance of communication, faith, and respect in their relationship.

Fans quickly responded with love and congratulations, praising the duo for their transparency and commitment. Their anniversary post included a mix of sweet anecdotes and reflections on what keeps their marriage thriving.

“7 years down, forever to go. Always communicate, always forgive, always put God first — these are our family rules,” Bieber wrote.

Brett James, Songwriter of ‘Jesus, Take The Wheel,’ Dies in Plane Crash

Hailey also shared a loving post, reflecting on their journey together, describing their marriage as a partnership rooted in faith, trust, and friendship.

Family Rules That Guide Their Marriage

Justin shared that one of their key family rules is to always prioritize each other despite busy schedules. Another rule he mentioned is to never go to bed angry, emphasizing the importance of resolving conflicts before the day ends.

The Biebers also focus on shared faith and prayer, which they credit for helping them navigate challenges together. Social media posts suggest that humor, honesty, and mutual respect are essential pillars in their relationship.

Fans React to the Couple’s Wisdom

Fans flooded the post with comments celebrating their love story. Many highlighted how Justin and Hailey Bieber set an example for young couples worldwide, showing that even in the spotlight, relationships require effort, rules, and commitment.

Social media buzzed with trending hashtags such as #BieberAnniversary, #JustinAndHailey, and #MarriageGoals, reflecting the public’s fascination with the celebrity couple.

Celebrity marriage 2025

As Justin and Hailey Bieber mark their 7th anniversary, they continue to share glimpses of their married life, offering both inspiration and relatability to their followers. Their dedication to keeping family and marriage at the center of their lives is a testament to their enduring bond.